LRT Deployments + AVS Yields, October 2024

LRT providers must take advantage of AVS rewards in order to maximise yields for restakers. Some LRT providers are steaming ahead in the race to deploy operators and register with AVSs.

EigenLayer yields

The next phase of EigenLayer yields will be captured by operators and restakers who are actively registered with AVSs. Yield comes in the form of AVS payments, boosted by EigenLayer's EIGEN token, alongside potential AVS airdrops for restakers. On the demand side, according to future plans, AVS teams will be incentivised to pay out yields in order to attract a greater share of EIGEN boost payments and, although the bulk of AVS yields will likely be generated by just a handful of AVSs, every AVS will generate some yield thanks to a rewards floor supported by the EIGEN token.

In order to capture AVS yields, LRT providers must delegate their capital to operators who are registered with AVSs. There are legitimate reasons why an LRT might have some capital sitting outside of EigenLayer, for example, LRTs need to provide liquidity for LRT/ETH pools and withdrawal buffers which are important for peg stability. However, excessive idle capital will dilute LRT yields and the discerning LRT holder will want to understand how much of their LRT provider's pool of capital is deployed on EigenLayer and which AVSs they are registered with.

LRT historical deployments

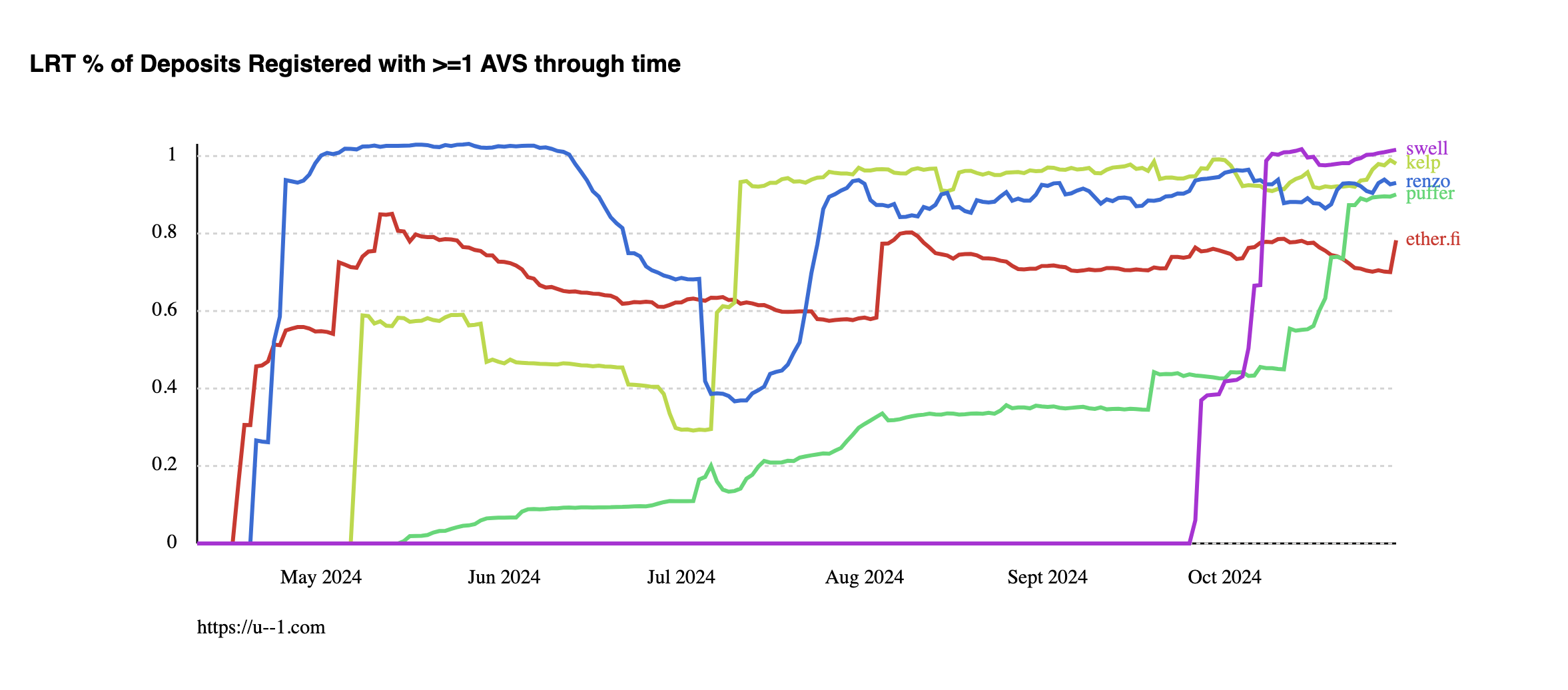

This chart shows the percentage of each LRT's deposits that is delegated to an operator that is actively participating in at least one AVS. Note that AVS rewards started in August.

Methodology: We find the total USD value of restaked assets (excluding EIGEN) for each operator. We match operators with LRTs using the operator name submitted to EigenLayer. For each LRT, we sum the total assets of operators that are registered with at least one AVS. We calculate the total assets as a proportion of the LRT's marketcap (roughly, their deposits).

Renzo (blue) and Kelp (yellow) are consistently performing well with over 90% of deposits actively deployed on EigenLayer and earning AVS rewards. EtherFi (red) has ranged between 70% and 80% deployed.

Puffer (green) and Swell (purple) are now both over 90% deployed. However, between August and October, pufETH and swETH LRTs were earning AVS rewards with less than 40% of their deposits - LRT holders will have been suffering diluted AVS rewards during this period.

LRT yield maximisation

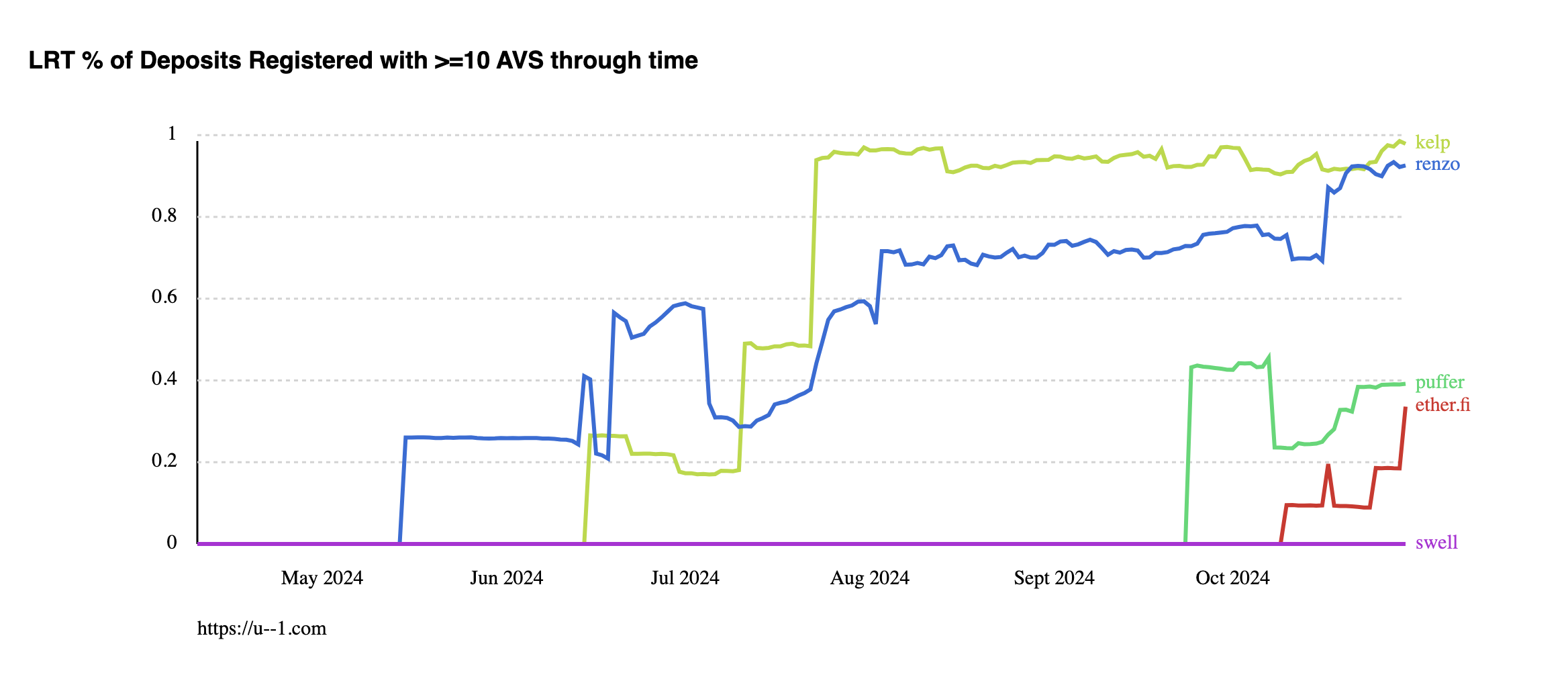

To further evaluate LRT yield strategies we can consider the number of AVSs each LRT operator participates in. This chart shows the percentage of each LRT's deposits that is delegated to an operator that is actively participating in at least ten AVSs.

Methodology: For each LRT, we sum the total assets of operators that are registered with at least ten AVSs. We calculate the total assets as a proportion of the LRT's marketcap (roughly, their deposits).

Ten is a large number and it really exaggerates the distinctions between LRT deployments, for example, many operators are registered with 8 or 9 AVSs and fall just below this theshold. On that understanding, the chart shows that Renzo and Kelp have deployed the majority of their capital to operators who are participating in 10 or more AVSs while other LRT operators have registered with 9 or fewer AVSs in general.

Caveats

AVS rewards and airdrops could favour certain LRTs for loyalty, unique security, operator uptime or other reasons not yet known. Also, LRT yields are reliant on Ethereum staking yields and can include other sources of income not explored here. AVS slashing risks will be an important consideration for yields when applicable.

Sponsor

This article is sponsored by Renzo.

Track the live LRT deployment rates on the u--1 LRT page.

Author

u--1

@geeogi